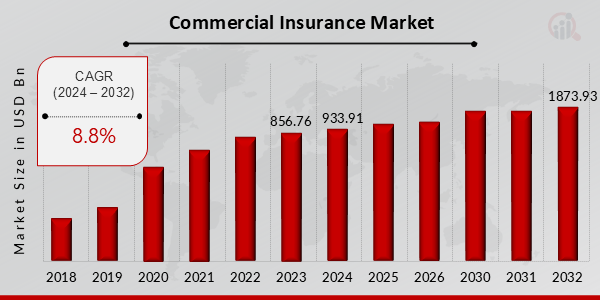

Commercial Insurance Market Size Is Likely To Reach a Valuation of Around $1873.93 Billion by 2032

Commercial Insurance Market Growth

Commercial Insurance Market Research Report By Coverage Type, Business Size, Industry Segment, Distribution Channel, Regional

MA, UNITED STATES, January 29, 2025 /EINPresswire.com/ -- The global Commercial Insurance Market has demonstrated steady growth in recent years, with expectations of continued expansion through the coming decade. In 2023, the market size was valued at USD 856.76 billion, and it is projected to grow from USD 933.91 billion in 2024 to an impressive USD 1,873.93 billion by 2032, reflecting a compound annual growth rate (CAGR) of 8.8% during the forecast period (2024–2032). This growth is largely driven by the increasing need for risk management solutions across industries, the expansion of small and medium-sized enterprises (SMEs), and rising awareness of insurance as a safeguard against unexpected business disruptions.

Key Drivers of Market Growth

Expansion of Small and Medium Enterprises (SMEs)

The growth of SMEs in both developed and emerging markets has significantly contributed to the demand for commercial insurance. As new businesses emerge and existing companies expand, the need for comprehensive insurance policies to cover property, liability, workers' compensation, and other business risks is increasing.

Rising Awareness of Risk Management

With increasing economic uncertainty and the frequency of natural disasters, businesses are becoming more aware of the importance of having adequate insurance coverage. Commercial insurance provides companies with essential protection against financial losses due to unforeseen events, encouraging more businesses to invest in such services.

Technological Advancements

The integration of advanced technologies such as artificial intelligence (AI), big data, and machine learning has transformed the commercial insurance landscape. These technologies are improving underwriting processes, risk assessment, and customer experience, making commercial insurance products more tailored and efficient.

Increasing Regulatory Requirements

In many regions, businesses are mandated by law to have certain types of insurance, such as workers' compensation or liability coverage. Stricter regulatory frameworks and the ongoing push for business accountability are driving the demand for comprehensive commercial insurance packages.

Growth in Emerging Markets

The rapid industrialization and urbanization in emerging markets, particularly in Asia-Pacific, Latin America, and Africa, are creating new insurance opportunities. As businesses expand in these regions, the demand for commercial insurance policies continues to rise, contributing to the overall market growth.

Download Sample Pages https://www.marketresearchfuture.com/sample_request/23980

Key Companies in the Commercial Insurance Market

• Hanover Insurance Group

• Allianz

• Tokio Marine Holdings

• Zurich Insurance Group

• Berkshire Hathaway

• Everest Re

• Liberty Mutual

• Munich Re

• Travelers

• Markel Corporation

• AIG

• Lloyd's of London

• CNA Financial

• Chubb

• AXA

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/commercial-insurance-market-23980

Market Segmentation

To provide a detailed analysis, the commercial insurance market is segmented by insurance type, industry, region, and size of businesses:

1. By Insurance Type

Property Insurance: Protecting against damage or loss to physical assets.

Liability Insurance: Covers businesses against lawsuits, including general liability and professional liability.

Workers' Compensation Insurance: Offering protection for employees injured on the job.

Business Interruption Insurance: Safeguarding against losses due to operational disruptions.

Other Insurance Types: Including health, life, and automobile insurance for commercial entities.

2. By Industry

Manufacturing: Insurance solutions tailored to address risks in production, machinery, and labor.

Retail: Coverage for businesses in the retail sector, including property, theft, and liability.

Technology: Protection for tech companies against cyberattacks, intellectual property theft, and data breaches.

Healthcare: Providing specialized coverage for hospitals, medical practitioners, and healthcare facilities.

Other Industries: Including hospitality, construction, transportation, and more.

3. By Region

North America: The largest market due to established insurance infrastructure, high demand for risk management, and regulatory frameworks.

Europe: Driven by a robust business environment, stringent regulations, and increased awareness of comprehensive risk coverage.

Asia-Pacific: The fastest-growing market, fueled by rapid industrialization, rising entrepreneurship, and increasing adoption of insurance solutions.

Rest of the World (RoW): Steady growth expected in Latin America, the Middle East, and Africa as businesses in these regions increasingly adopt commercial insurance policies.

4. By Business Size

Small Enterprises: Increasing uptake of affordable, customized insurance products.

Medium Enterprises: A growing segment in need of comprehensive, specialized coverage.

Large Enterprises: Enterprises with complex insurance needs, requiring tailored and large-scale insurance solutions.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=23980

The global commercial insurance market is on a strong growth trajectory, fueled by factors such as the rise of SMEs, increasing business risk awareness, technological innovations, and expansion in emerging markets. As businesses across industries continue to recognize the need for effective risk management solutions, the demand for commercial insurance products will rise. With increasing regulation, technological advancements, and the continued globalization of business operations, the commercial insurance market is poised to play a critical role in providing businesses with the protection they need to navigate a rapidly evolving economic landscape.

Related Report:

Consumer Durable Loans Market

Debt Financing Market

About Market Research Future

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Distribution channels: Insurance Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release