Generative AI in Banking Market Boost NLP segment By 36%, Retail Banking Customers Segment By 27%

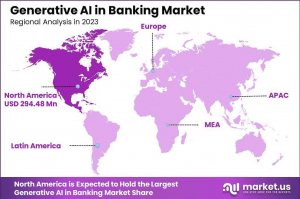

In 2023, North America held a dominant market position in the generative AI in the banking sector, capturing more than a 36% share...

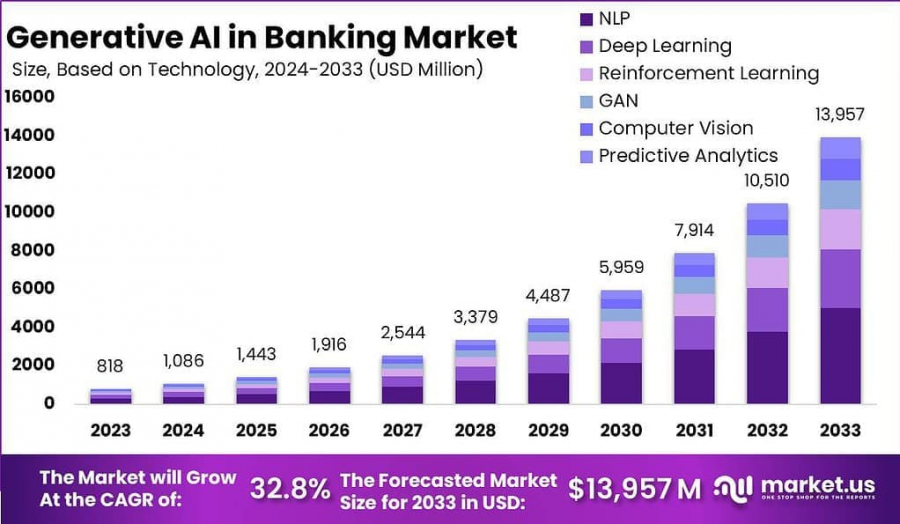

NEW YORK, NY, UNITED STATES, January 24, 2025 /EINPresswire.com/ -- The global Generative AI in Banking Market is experiencing rapid growth, projected to expand from USD 818 million in 2023 to USD 13,957 million by 2033, reflecting a robust CAGR of 32.8% during the forecast period. Several factors are driving this growth, including the increasing adoption of AI for automating tasks such as customer service, fraud detection, and personalized financial services. The rising demand for more efficient, scalable, and secure banking solutions is fueling the shift toward AI-driven technologies.

Technological advancements, particularly in natural language processing (NLP) and machine learning algorithms, are transforming the banking sector by enabling smarter decision-making, real-time data analysis, and improved customer interactions. Banks are increasingly relying on generative AI models to enhance user experience by providing personalized advice, automating back-end operations, and improving risk management.

🔺 Click Here To Get a PDF Research Sample (no cost) @ https://market.us/report/generative-ai-in-banking-market/request-sample/

Market trends indicate a growing emphasis on AI-powered chatbots, AI-driven credit scoring, and generative algorithms for predictive analytics in lending. Additionally, the increasing need for regulatory compliance and fraud prevention is prompting banks to integrate AI tools for enhanced security and efficiency. With a strong demand for digital transformation in banking and continuous technological advancements, the generative AI market in banking is expected to play a key role in shaping the future of financial services.

Key Takeaways

The Generative AI in Banking Market is projected to reach USD 13,957 million by 2033, growing at a robust CAGR of 32.8% throughout the forecast period.

In 2023, the Natural Language Processing (NLP) segment led the market, accounting for over 36% of the total market share, driven by its use in enhancing customer interactions and automating processes.

The Retail Banking Customers segment held the largest market share in 2023, reflecting the high demand for personalized, AI-driven services in the retail banking sector.

🔺 Hurry Exclusive Discount For Limited Period Only @ https://market.us/purchase-report/?report_id=119492

Key Statistics

The adoption of generative AI technologies across industries, especially in the banking sector, is expected to bring substantial economic advantages. By automating tasks such as customer service, fraud detection, and data analysis, generative AI is projected to reduce operational costs by 9% while increasing sales by the same margin. This balanced improvement underscores the technology's potential to optimize efficiency and drive revenue growth simultaneously.

In banking, the impact of generative AI on productivity is significant. It is anticipated that productivity could increase by 2.8% to 4.7%, as AI streamlines repetitive tasks and enhances decision-making capabilities. The technology will allow banks to focus on high-value activities such as personalized customer service and complex financial analysis, boosting overall performance.

Furthermore, the use of generative AI in customer interactions through natural language processing (NLP) is expected to improve customer engagement, driving loyalty and retention. AI-powered chatbots and virtual assistants can handle large volumes of customer inquiries more efficiently than traditional methods, leading to improved customer satisfaction.

As generative AI technologies evolve, their economic and operational benefits will continue to grow. The banking sector, in particular, stands to gain from this technological evolution, paving the way for more efficient operations and enhanced customer experiences in the coming years.

🔺 Get a PDF Research Sample (no cost) @ https://market.us/report/generative-ai-in-banking-market/request-sample/

Experts Review

The Generative AI in Banking market is witnessing rapid growth, driven by technological innovations and government incentives. Governments are increasingly recognizing the potential of AI to enhance financial services, leading to policies and funding aimed at fostering AI research and development. These incentives are accelerating the integration of generative AI in areas like customer service, fraud prevention, and risk management, improving operational efficiency in banking.

Technologically, advancements in natural language processing (NLP), machine learning, and predictive analytics are revolutionizing the banking sector. Generative AI is not only automating routine tasks but also enhancing decision-making capabilities, making processes more accurate and efficient. This innovation offers significant opportunities for investment, as financial institutions seek AI solutions to stay competitive.

However, the market also comes with risks, including data privacy concerns and ethical challenges in AI decision-making. Additionally, regulatory environments are evolving, with governments implementing new guidelines to address AI-related risks in sectors like banking. Strict compliance requirements may affect the speed of adoption, but also create opportunities for companies that specialize in AI governance and secure deployment.

As consumer awareness of AI grows, customers are becoming more receptive to AI-driven banking solutions. However, ensuring transparency and trust in these technologies will be essential for long-term success. The regulatory landscape will continue to shape the market, balancing innovation with consumer protection.

🔺 Get the Full Report at Exclusive Discount (Limited Period Only) @ https://market.us/purchase-report/?report_id=119492

Report Segmentation

The Generative AI in Banking market can be segmented based on technology, application, end-user, and region, providing a detailed understanding of its growth dynamics. By technology, the market includes natural language processing (NLP), machine learning, and deep learning, with NLP dominating due to its use in customer service automation and chatbots. By application, key segments include customer support, fraud detection, risk management, and personalized banking, with customer support and fraud detection leading the way as banks increasingly rely on AI for enhancing service delivery and security.

By end-user, the market is divided into retail banking, commercial banking, and investment banking. Retail banking holds the largest share, driven by AI’s ability to personalize financial products and streamline transactions. Regionally, the market is segmented into North America, Europe, Asia Pacific, and the Rest of the World. North America is expected to maintain a dominant position, benefiting from advanced infrastructure, high AI adoption rates, and strong investment in financial technology.

This segmentation reveals how generative AI is transforming banking operations, helping financial institutions reduce costs, enhance productivity, and improve customer satisfaction across various regions and application areas.

Key Market Segments

Based on Technology

-- Natural Language Processing

-- Deep Learning

-- Reinforcement Learning

-- Generative Adversarial Networks

-- Computer Vision

-- Predictive Analytics

Based on End-User

-- Retail Banking Customers

-- Small and Medium Enterprises

-- Investment Professionals

-- Compliance and Risk Management Teams

-- Operations and Process Optimization

-- Executives and Decision Makers

🔺 Get a PDF Research Sample (no cost) @ https://market.us/report/generative-ai-in-banking-market/request-sample/

Key Player Analysis

The Generative AI in the Banking market is led by key players that are driving innovation and the adoption of AI technologies within the financial sector. OpenAI, with its advanced models like GPT-3 and GPT-4, is playing a critical role in enhancing customer interactions, automating financial tasks, and improving decision-making processes in banking. IBM is another significant player, offering solutions through its Watson AI platform, which specializes in data analytics, fraud detection, and risk management in banking.

Google Cloud provides AI tools that assist banks in optimizing operational efficiency and improving customer experience through AI-driven chatbots and predictive analytics. Microsoft also stands out with its Azure AI services, enabling banks to integrate advanced machine learning and AI models to enhance personalization and operational workflows.

Accenture is a consulting leader helping banks implement generative AI strategies, focusing on improving productivity and reducing operational costs. These players, alongside others like Cognizant and SAP, are essential in shaping the future of AI in banking by providing innovative, scalable, and secure solutions for the industry.

🔺 Hurry Exclusive Discount For Limited Period Only @ https://market.us/purchase-report/?report_id=119492

Top Key Players in the Market

OpenAI

Google

IBM

Microsoft

Salesforce

Amazon Web Services

Traditional Banking Institutions

Other Key Players

Recent Developments

Recent developments in the Generative AI in the Banking market showcase significant strides in AI integration and innovation. In 2023, OpenAI partnered with several leading financial institutions to enhance customer service operations, integrating its GPT models for more personalized and efficient client interactions. IBM has also advanced its AI offerings with updates to its Watson platform, focusing on fraud detection and regulatory compliance, providing banks with more robust tools for managing risks.

Moreover, Microsoft has expanded its AI capabilities in the banking sector through its Azure AI platform, helping financial institutions improve decision-making and operational efficiency. Accenture has made notable progress with AI-driven solutions for automating back-office tasks, increasing productivity, and cutting operational costs.

In terms of product development, AI-driven chatbots and virtual assistants are being deployed more widely, improving customer engagement and providing personalized banking experiences. These advancements are setting the stage for wider adoption of generative AI technologies, with significant impact on customer experience, operational efficiency, and risk management.

Conclusion

The Generative AI in Banking market is experiencing rapid growth, driven by technological innovations and increasing demand for automation, efficiency, and personalized services. Key players like OpenAI, IBM, and Microsoft are leading the charge, offering advanced AI solutions for customer service, fraud detection, and risk management.

While challenges such as regulatory compliance and data privacy persist, the market presents substantial opportunities for investment and growth. With continuous advancements in AI technologies and broader adoption across financial institutions, generative AI is set to reshape the banking landscape, enhancing both operational efficiency and customer experience.

Explore More Trending Topics

Asset Based Lending Market - https://market.us/report/asset-based-lending-market/

Live Streaming Pay Per View Market - https://market.us/report/live-streaming-pay-per-view-market/

Taxi App Market - https://market.us/report/taxi-app-market/

E-Commerce Logistics Market - https://market.us/report/e-commerce-logistics-market/

Shooting and Gun Accessories Market - https://market.us/report/shooting-and-gun-accessories-market/

Quantum Networking Market - https://market.us/report/quantum-networking-market/

Cloud Music Services Market - https://market.us/report/cloud-music-services-market/

Cloud Native Applications Market - https://market.us/report/cloud-native-applications-market/

Hyperscale Data Center Market - https://market.us/report/hyperscale-data-center-market/

Data Center Infrastructure Management Market - https://market.us/report/data-center-infrastructure-management-market/

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release